Endowment

Establish an endowment fund to benefit Guadalupe Center. Your endowment can fund a particular program or position, or help with general operating needs. You can contribute directly to one of the existing endowment funds, or with a minimum contribution, establish a new named endowment.

What is an Endowment Fund?

An endowment fund is a donation of money or property for the purpose of ongoing support. Typically, an endowment fund is structured so that the principal amount is kept intact while the investment income is available for use or a part of the principal is released each year extending the impact of the gift over a longer time period.

Building Guadalupe Center’s endowment is one of the most important investments you can make. Endowment will guarantee the stability and continuity of our programs for generations to come, ensuring that children in Immokalee have access to resources and programs that break the cycle of poverty through education.

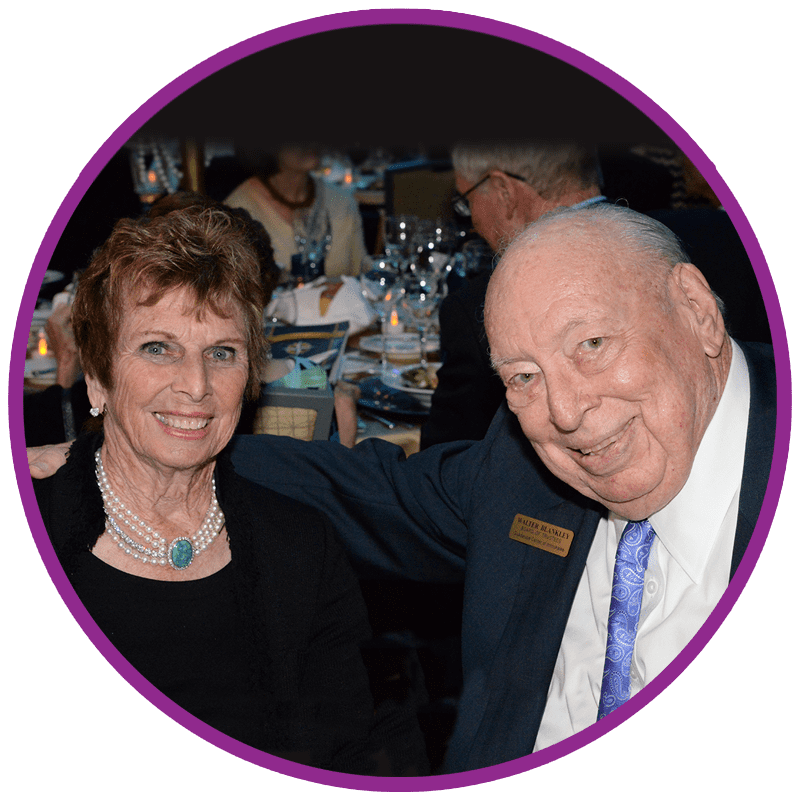

In 2016, longtime advocates Rosemary and Walter Blankley created the Blankley Endowment challenge to directly support scholarships for Tutor Corps students. They invited others to join them by contributing to the endowment. This resulted in $1 million gift from the Blankleys to match the funds raised. Today the fund has more than $3 million dollars, and helps ensure Guadalupe Center’s annual scholarship commitment is met each year. The Blankley Tutor Corps Scholarship Endowment is a powerful example of how donors can compound their gift to sustain and grow our programs.

“My opinion of Guadalupe Center is that it is the most effective organization of this type I have ever witnessed. People should consider what we do in Immokalee as best practice.”

Walter Blankley (1935-2020)

Retired CEO, Ametek

Guadalupe Center Board member (2007-2020)

Legacy of Hope Society

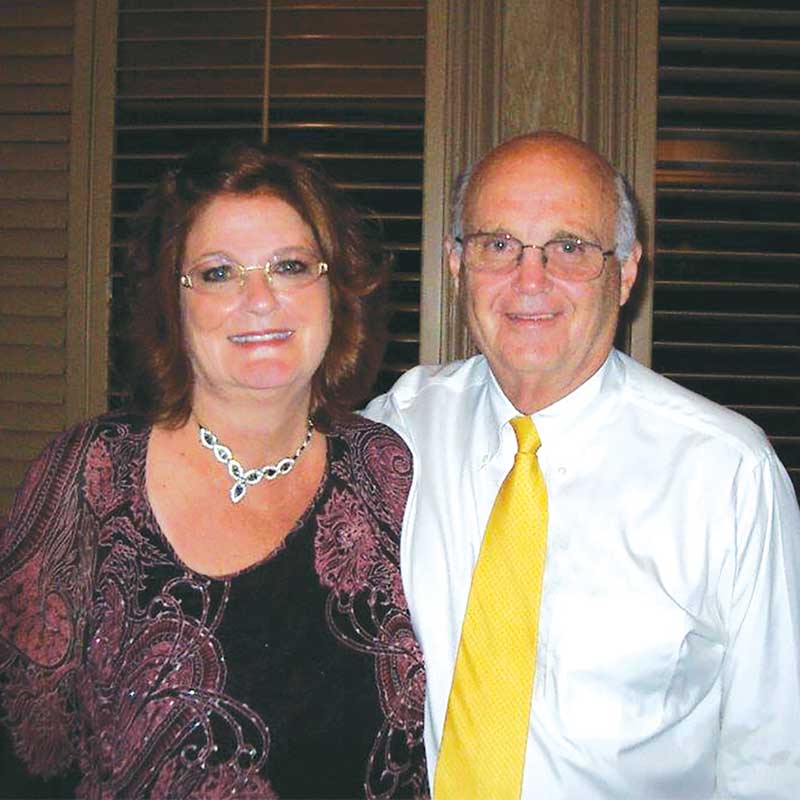

Martha and Ray Wernig, longtime donors of Guadalupe Center, were among the first investors in the Endowment Fund of Guadalupe Center 2020 & Beyond. The Wernigs made the lead gift and established the Wernig Early Childhood Education Endowment Fund. “Without good teachers, Guadalupe Center cannot provide the excellent Early Childhood Education they currently offer, and providing the right environment for teachers is crucial.” – Ray Wernig

Their commitment was extended through an estate gift solidifying their place in the Legacy of Hope Society. Their generosity continues to support our students and teachers today. The Wernigs are just one example of how donors can make gifts that leave a lasting legacy through planned giving.

Planned Gifts

Many planned gifts such as a bequest, beneficiary designation, charitable trust, or gift through an IRA, life insurance policy or appreciated securities can reduce taxes, increase income or satisfy other personal financial goals while benefiting the Guadalupe Center. Planned gifts allow you to be there for the charities that need your support beyond your lifetime. They also provide flexibility – you can change your mind should your personal or financial situation change.

“We wanted to support Guadalupe Center over many years, but we wanted to do it in an intelligent way in terms of potential tax savings, and perhaps having some funds left over.”

– Debi and George Braendle, who established a Charitable Lead Trust (CLT) to support the building maintenance fund.

To learn more, contact Kelly Krupp, Vice President of Philanthropy at 239.657.7126 or KKrupp@GuadalupeCenter.org.

Professional Advisors

Our voluntary professional advisors have a great deal of experience in assisting individuals and families with planned giving strategies. We recommend consulting your attorney or advisor when considering a planned gift. The following is a list of professional advisors familiar with Guadalupe Center that can assist you or your advisor with any questions you may have:Juan Bendeck, Esq.

Shareholder, Trust, Estates and Wealth Preservation

Dentons Cohen & Grigsby

Dan Capes, Esq.

Shareholder, Trust & Estates Attorney

Dunwody White & Landon, P.A.

Council Chair

Robert (Bobby) Carroll

Partner

Galbraith Weatherbie Law

Robert (Bobby) Davis, MM, CLU®, CLTC

Field Director, Wealth Management Advisor

Northwestern Mutual

Kelly R. Dee, CPA, CFP®

President

Dee & Associates

Charles M. Jarrett, CFP®, CPWATM, CEPA, CIMA®, ChFC, CLU, CRPC®

Senior Vice President, Private Wealth Advisor

Merrill Private Wealth Management, Cenname Team

Charles A. Kerwood III, CFP®, ChFC®, AEP®

Partner

Waller Financial Planning Group, Inc.

Alon Naftali

Senior Vice President

Fifth Third Bank

Sophia Scarcella

Trust & Estates Attorney

Wilson & Johnson

Ellen Vanderburg, CPA

Retired, CPA and Senior Fiduciary Manager

Legacy of Hope Society

Mark Warnken

Senior Vice President, Senior Wealth Advisor

Bessemer Trust